M.E.T.T.S. - Consulting Engineers > White Papers > JORC and PRMS, Resource and Reserves Reporting

JORC and PRMS, Resource and Reserves Reporting

Dr. Michael C. Clarke, FAusIMM, CPEng, FIEAust, RPEQ, MPESA (Mining and Chemical)

M.E.T.T.S. P/L, Consulting Engineer, Infrastructure Developing & Resource Management

Email: metts[at]metts.com.au

Abstract

Understanding the increasing importance of including Modifying Factors (MFs) in reporting on Extractive Industry (EIs) mineable reserves and resources and thus their real value, is the core of this paper. MFs have a major role in determining if resources can be converted mineable reserves.

JORC Code, a reporting tool, has provided additional certainty to investors, executives, workers, government and the community with respect to the veracity of quoted mineral resources and reserves from the early exploration stage (the "find" stage) to the mining and shipping stages. Investments opportunities can be scrutinised with the JORC Code. The progression of the JORC Code over the last two decades has seen an expansion of the MFs in terms of additions to the list and the overall importance of the MFs to the establishment of Extractive Opportunities from project inception through production to the end of production and site rehabilitation. The JORC code lists the following MFs: mining, metallurgical factors, economic factors, marketing, legal, environmental, security, and governmental factors to which should be added logistics, infrastructure and security; these factors can be considered singularly or in groups e.g. legal, security and social.

An example of adding a new MF: The concept of Logistics could be added to the listed MFs. Having favourable logistics is crucial to most extractive industry projects. Further each factor could be expanded with descriptions of what comprises a factor and actual examples of how these factors affect the EI's and how they can best be managed being presented.

Logistics in part overlaps with infrastructure but includes the concept of having systems that relate to materials movement, that bring together infrastructure, services and materials handling that to go to make the mining, processing, and the flow of product from mine to market work. Bulk minerals such as coal and iron ore require sound logistics (in terms of capacity, flow rates and costs); coal logistics are discussed in detail in the following pages. Other MFs that can be considered for inclusion are, personnel and plant security and MFs that are part of the economics/finance of a project, being, Corporate Tax, Royalties, Fuel Excise and Depreciation and legislation on wastes management. Perhaps the most important MF in the finance field is the status of the Sovereign Risk (SR) in a national/finance sense and is a MF that is largely outside the control on investors and venturers.

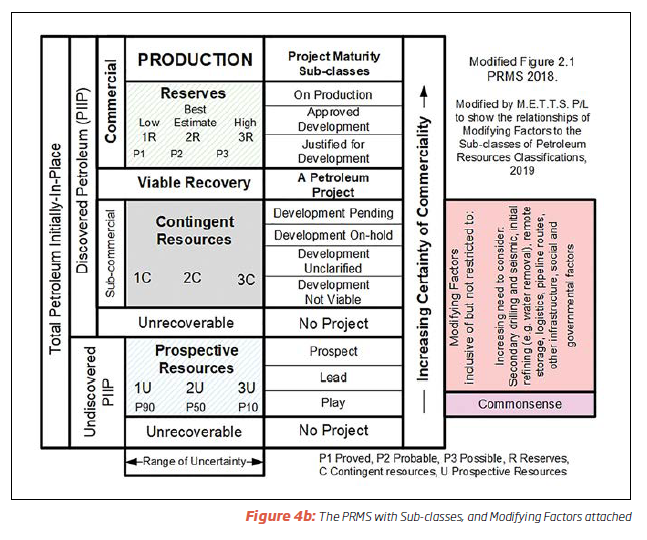

PRMS 2007 has fleeting references to Modifying Factors like that stated in Section 1.2. "Conditions include technological, economic, legal, environmental, social, and governmental factors. While economic factors can be summarized as forecast costs and product prices, the underlying influences include, but are not limited to, market conditions, transportation and processing infrastructure, fiscal terms, and taxes." PRMS 2018 has explored MFs in detail but has not linked the MFs to the schematics contained in that system. This paper suggests linking appropriate MFs to PRMS. Comment is welcomed on this linkage as well as the narrative and tables, figures and schematics that comprise this paper.

1.0 A brief background of the JORC and PRMS Reporting Codes

Like other industries, the EIs of the minerals and petroleum sectors have been the haven for optimists, opportunists, rogues and dedicated thieves. The boom and bust nature of the Extractive Industries (EIs) has allowed scams and scammers to be recycled every fifteen to twenty years; those many investors who burnt their fingers on a previous cycle either forget previous misfortune and reinvest, shuffle off to the nursing home or are wisped-off to a funeral parlour; then there are always new chums ready to be fleeced.

The Bre-X scam of 1995 was a classic example of massive mining exploration fraud; could a functioning reporting system have curtailed the fraud? Perhaps! A recent fraud involving Sino Australia Oil and Gas Limited (in Liquidation) occurred despite the existence of a reporting code; the public documents provided by the company contained falsehoods, so we have, "Her Honour found that Sino had contravened sections 728(1)(a) - 728(1)(c) and 1041H of the Corporations Act 2001 by offering shares in it under the Replacement Prospectus dated 26 April 2013 and subsequent Supplementary Prospectuses by providing false and misleading information contained therein" (Shareholder update 8th June 2018 by Ferrier Hodgson).

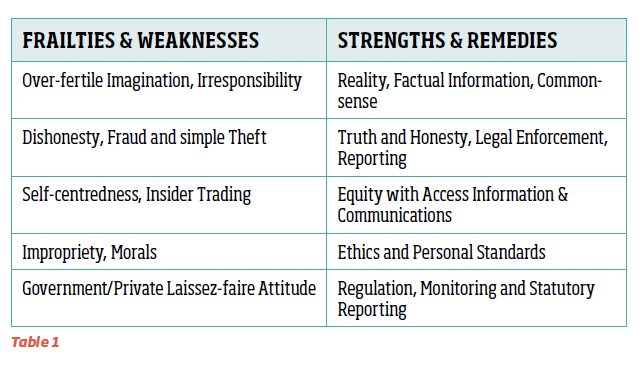

The avoidance of scams can happen if Frailties and Weaknesses are recognised and overcome, and Strengths and Remedies are recognised and applied respectively - See Table 1.

Over the last two decades the community, industry, commerce and government have sought additional confidence in the reporting of mineral finds; JORC is a tool that can assist in that aim. Changes in mineral exploration over that same period have resulted in the need for a steady reappraisal of the tool. Of note are the changes in the importance of "modifying factors" and indeed the addition of extra factors; infrastructure followed by logistics and security, labour and OH&S (the last four being the suggestion of this author).

JORC can also be a tool for customers for minerals. A thorough JORC Compliant Report that includes conservative estimates of recoverable and marketable reserves are factual, assurance that processing and logistics factors are favourable, that community and government concerns are managed and that the mine can deliver on time and within specification are important for customers who are making down-stream development decisions.

MFs, if they are not favourable to a project can be a project breaker. If favourable, MFs, for instance, a useful logistics option has become available (such as capacity ion another operator's railway or a pipeline), then the logistics modifying factor can and should be reported in public documents in an honest and timely way. Such an example would be fair and positive claim.

Using MFs as a checking tool to look at the viability of an EI project is appropriate and is a tool that can be used during the life of a project for updating and reporting on hazard management. The MF tool should be regularly updated to bring in new relevant factors or discard irrelevant factors.

2.0 Examples of the Use of Modifying Factors in JORC

2.1 Coal: For coal, an industrial mineral, the most important MFs are concerned with getting coal to market and the market itself; logistics, infrastructure, environment, societal and market factors are very important.

Over the last fifteen years substantial coal discoveries have been made in the Northern Territory (NT). The coal rank is brown/sub-bituminous with a useful Specific Energy (SE) of 22 - 24 GJ/t which is marginally higher than coal in the Galilee Basin, Queensland. It is a good thermal coal. The coal is biologically mature but thermally immature; it has virtually no gas associated with it. It is situated a long way from, ports (over a thousand kilometres to Darwin or Port Bonython), and the existing north-south railway and the north-south highway. Rail, road/rail and slurry transport are not presently economically feasible, and Underground Coal Gasification (UCG) is too immature a technology to be seriously considered and given its poor environmental record in Queensland, would likely not be applied in the NT.

A major hurdle however would be the market for the coal; low to medium SE thermal coal attracts a price of under $US 80/tonne and has been as low as $US 45/tonne over the last two years; this is not good when considering the likely coal production cost per tonne that takes into account new CAPEX, OPEX and Government imposts as well as mining and washing, plus legal costs in meeting Social License to Operate (SLTO) challenges. The development of NT coal resources may thus take a few decades to become financially feasible; perhaps never!

Another coaly example: A major development that is currently being challenged is the Adani Carmichael project in the Galilee Basin, a project with reasonable logistics. That project is being attacked in multiple ways, these include, access to rail and port use, environment, withdrawal of SLTO, the legality of leases and clearances, economic viability and security. Adani has recently received the go-ahead after years of challenges.

JORC MFs have been crucial to understanding the reporting challenges of these coal developments.

2.2 Helium: Helium (He) is a gaseous mineral that is a component of some natural gas resources. There was great hype two to three years ago that Helium could reach astronomical prices due to impending shortages caused in part by the hunger of Magnetic Resonance Imaging (MRI) for He. Prices for liquid He have increased to over $US 8/scm in Asia, however the demand for He for MRI machines is expected to come down with newer units only requiring a few litres as against around 100 litres for machines that are now in service.

As well as potential weakness in demand in a few years, He has been "democratised" with supply coming from multiple sources such as Qatar, Algeria, Russia, Poland..., as well as the USA that is selling-off its strategic He reserve. Australia has one producing "He field" and one separation plant where around 3% of the world's He is produced. Helium finds have been reported for Tanzania, S. Africa and Central Australia.

Logistics and infrastructure are expensive for this resource, with liquid helium (LHe) requiring large cryogenic flasks that have a maximum delivery cycle time of 45 days before boil-off. For He the MFs can be managed so long that there is enough extractable He in the natural gas, development costs can be kept in-check and policies like banning fraccing can be removed. With luck, a solid well financed exploration effort plus with low Sovereign Risk, Australia may have the opportunity to become a major future He supplier based on recent NT finds and other prospects. Should He be covered by PRMS since it is found in association with petroleum or is it best covered by the JORC Code? Whichever code is used MFs are critical to understanding the economics of the project.

2.3 Lithium and Cobalt: elements with high potential in battery development

Elements suitable for use in large battery storage have become subject to a "moving boom" that has seen the "battery mineral" prices rise as the concept that the national power grids (Eastern Australian and Western Australian) being supported by battery storage has taken hold.[1] The elements include, lithium, cobalt, nickel, cadmium, vanadium, zinc, manganese, bromine, carbon (graphite) and silica.

There will be winners and losers in the battery stakes, i.e. the market for some elements (as minerals) will not be as solid as has been predicted; there will be specific element substitution as batteries develop and recycling may become a norm in the large battery industry. Also. the overall use of batteries to support the grid is an expensive option and battery manufactures will be seeking lower price options by using alternative elements and better battery design that reduce specific element requirement and costs.

Batteries and their constituents have hidden costs, such as a variable life and reducing capacity with time, recycling challenges and their innate low efficiency (with respect to low energy densities, high and variable recharge times and the energy losses during charging and discharging; partially caused by two conversions between AC to DC and heat losses).[2]

When using the JORC Code for battery minerals the MFs that are most applicable are markets (customers), metallurgical challenges (e.g. the use of SALAR [salt-pan] derived Li in place of hard-rock sourced Li) and environmental factors. The societal challenges will be tempered since the battery manufacturers will point out the link between batteries and renewable energy (wind and PV). However, people that live close to battery mineral processing, recycling and waste disposal may not be overly impressed or sympathetic.

2.4 Summary

In the three examples provided, two (a Coal resource and generalised Helium development) are very dependent on successful logistics. The third example examines minerals that host elements used in large scale battery development. This example looks at the mining and processing of minerals that are potentially required for very large-scale battery developments, however the battery technologies that are still in development will require certain elements of high purity and not others. Here it would be wise for proponents of "battery mineral" projects to carefully utilise the "Markets" MF category to stay ahead of market and technological developments.

3.0 Improving JORC to match trends in Mineral Exploration and Funding Extraction Industry Projects The JORC Code is a tool "for Reporting Exploration Results, Mineral Resources and Ore Reserves" that "sets out minimum standards, recommendations and guidelines for Public Reporting in Australasia of Exploration Results, Mineral Resources and Ore Reserve" (JORC, 2012).

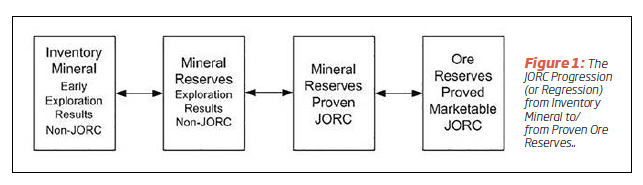

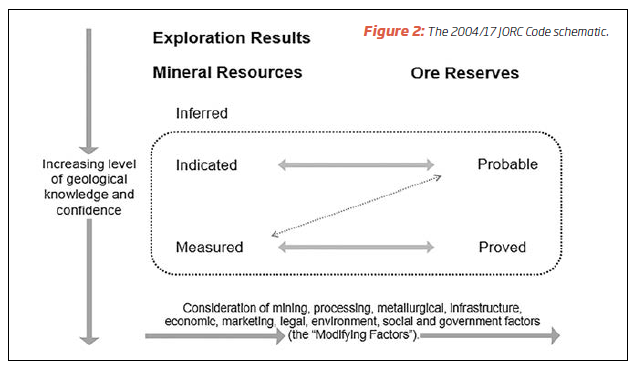

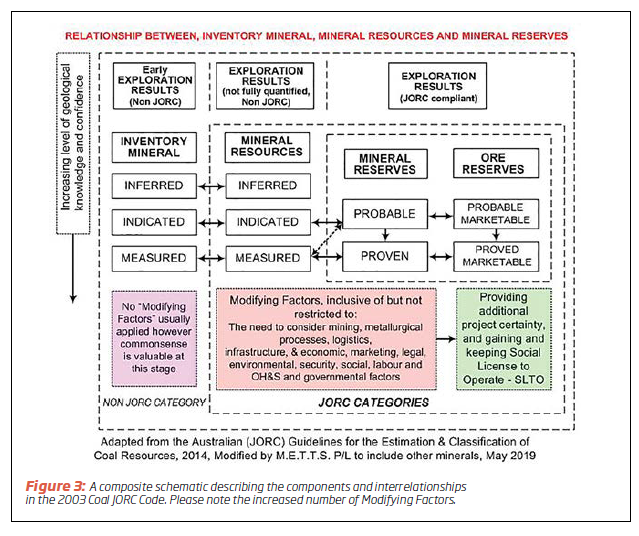

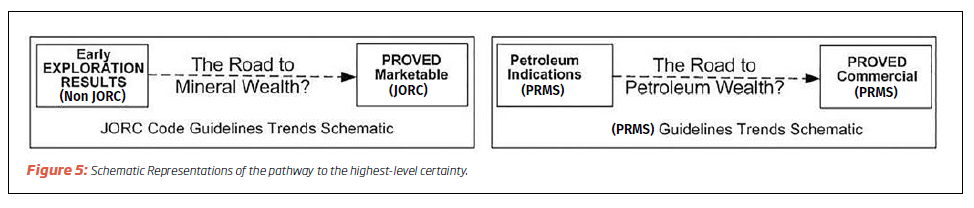

JORC can be best described in a schematic such as shown in two versions, Figures 2 and 3 below.

The Components and Interrelationships that exist in the JORC Schematic above are important; in an earlier version of JORC schematic (e.g. Figure 2, 2004 - Coal [modified for minerals]) those components and interrelationships are far better demonstrated than the recent simplified/redacted schematic, Figure 3.

3.1 Comments on Specific MFs

3.1.1 Infrastructure

Infrastructure and services inclusive of but not limited to:

- Major product transport infrastructure including of rail, road, barge and/or ship and ancillary equipment, plus mining equipment, fuel delivery, general stores, chemicals and provisions for the workforce,

- Water supply, water treatment before use, water recovery from mine wastes, water storage, water transport, disposal of watery sludge produced by water treatment,

- Environmental auditors, NORM auditors, OH&S auditors,

- Liquid fuel supply, electricity supply (if dependent of the local grid),

- Air services, either dedicated or regional public,

- Medical services that are both immediate and extended (RFD), and

- Communication services...

Infrastructure for coal development including, nuts and bolts, engineers and technicians to install, commission, run and maintain the plant is expensive and at this this time with some opposition from communities (who provide Social License to Operate - SLTO), international "green" opposition to coal (legal, governmental, environmental and economics/finance constraints MFs) will keep that coal in the ground and lost opportunities for those involved in supplying infrastructure.

3.1.2 Logistics

For bulk minerals such as iron ore, coal and bauxite having a good logistics to move product is important; the financial health of EI projects (including industrial minerals and aggregates) often have transport and other logistics costs such as storage at an intermediate point and transloading costs exceeding mining and processing costs.

An example of how logistics became an insurmountable challenge was discussed in the first example of the application of MFs to a mineral discovery, that being Northern Territory coal. For the NT coal finds, no financially viable ways of getting coal (or coal products) to market were discovered during a logistics feasibility study. Rail, road/rail, road, slurry delivered through a pipeline or UCG product gas delivered through a gas pipeline are NOT feasible at this time.

If parallel infrastructure developments such as the development of several regional mineral projects occurred, then there should be a rethink. One possibility is the use of the NT coal in a mine mouth power station and/or the use of the coal for conversion to Ultra Clean Diesel with both power and diesel being consumed primarily by the new metalliferous mines in the region.

3.1.3 Security

Australia is an exporter of energy (e.g. coal, condensate, LNG and uranium) and a major user of energy for industry, commerce and the community. Australia has a major hazard in that energy as power from the grid or finished transport fuels may not always be available, or otherwise be available at prices beyond what can be paid by the EIs and commerce that supports the EIs. Unless a solution can be quickly found to achieving continuity of energy supply at affordable prices, industries such as aluminium and steel production, will disappear. Energy Security is a commodity that once lost is very expensive to regain.

An advantage that Australia has had but is slipping away is "security", that being security of generally having:

- tenure of leases, fair environmental laws and policies, an honest and impartial justice system,

- a finance industry that is not frightened by NGOs that mix politics and pseudo-science,

- retained Social License to Operate (SLTO),

- no fear that their investment choices will be subject to attempts of financial sabotage,

- policy continuity across all levels of government,

- having a mix of government and private partnerships that are beneficial to all, and

- industry and society interaction that produces fair and workable relationships between stakeholders.

Australia is becoming a lost utopia with instances like the collapse Coronation Hill gold/palladium project, bans on gas exploration in New South Wales, fraccing moritoria in several states, and continued challenges Adani's Carmichael approved coal project producing a high level of industry angst and societal anxiety with the result being the creation of Sovereign Risk (SR) for all of the Extractive Industries.[3]

Once SLTO is lost, Sovereign Risk causes investment sources to look for "easier" projects and/or higher interest rates for covering their additional (real and perceived) risk. In the case of new coal fired power generation the increased Sovereign Risk has already seen the Federal Government suggest that they would guarantee the investment; the National Energy Guarantee (NEG) is actually a retreat from having government out of the power generation business.[4]

3.1.4 Other Potential MFs - Ongoing Financial Inputs

Corporate Tax, Excise on Fuel, Depreciation and Employee Superannuation may also be considered as future MFs.

4.0 Reporting

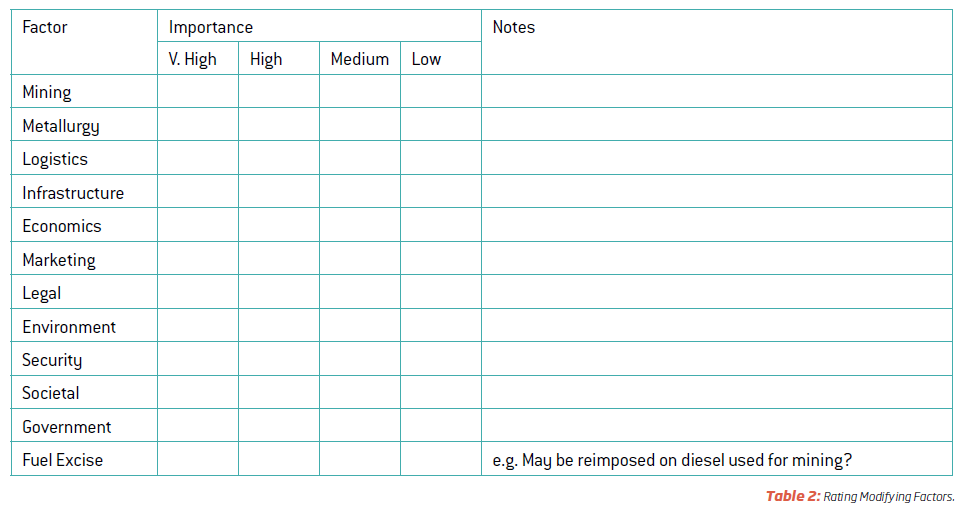

Discovering the "true potential" of a mineral find is the core theme of the JORC Code. The information gained in a "JORC study" must be reported in fair and accurate ways. Modifying Factors have differing "weights" for different circumstances (geological, geographical, climate, logistic options, etc.) and often vary with time. A useful tool is an initial review of MFs using Table 2; as exploration results come in and are categorised as JORC compliant or not they can be fitted into the progression (or retreat) of Inventory Mineral <--> Mineral Resources <--> Mineral Reserves <--> Ore Reserves (Figure 3).

JORC is a tool that is useful to investors and financiers, mine planners and regulators, and customers for minerals and mineral related products.

5.0 Petroleum Reporting

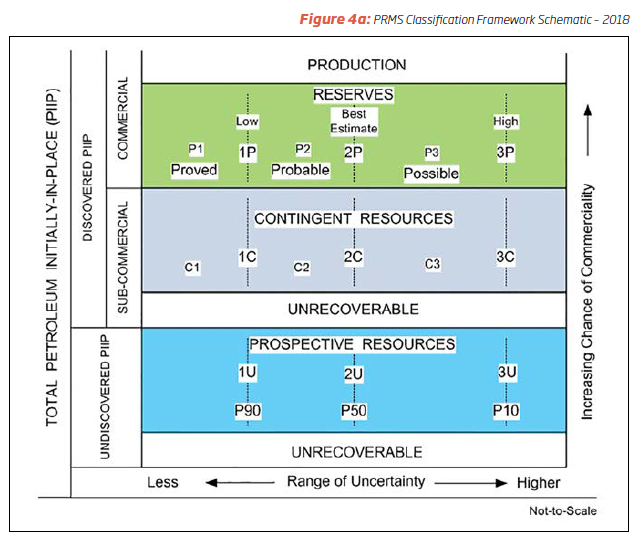

The AusIMM and similar mineral orientated groups have tended to leave "Petroleum Reporting to others". These include the Society for Petroleum Engineers (SPE) and the World Petroleum Council (WPC), the American Association of Petroleum Geologists (AAPG), the Society of Petroleum Evaluation Engineers (SPEE), the Society of Exploration Geophysicists (SEG) Society of Petrophysicists and Well Log Analysts (SPWLA), and the European Association of Geoscientists & Engineers (EAGE), who jointly have produced the Petroleum Resources Management System (PRMS). See Figure 4a.

The distinctions between minerals, coal and petroleum, however, are becoming blurred; most petroleum is produced by "non-entry mining methods", which are very similar to non-entry uranium, potash and sulphur mining. Very heavy petroleum in the form tar-sands are mined by open-cut mining methods, and gas is extracted from coal that is considered too challenging for mining or part of a coal mining process as a fire and explosion control safety measure in underground workings. Note: Methane may be created via UCG.

It is suggested that a more formal way of applying MFs could provide more certainty in reporting. An example is in how to manage "fraccing politics" with its significant Social License to Operate (SLTO) connotations in a national, state and territory framework. A second reason for formal application of MFs to petroleum in Australia is product logistics, in that given the distances between well and market are great and appropriate infrastructure is not present, a major examination of logistics/infrastructure options is required.

The PRMS does not include MFs in the following paragraph, "Moreover, modifying factors that may additionally influence investment decisions, such as contractual or political risks, should be recognised so the entity may address these factors if they are not included in the project analysis", except in a very limited way. Also, the following alludes to MFs, "The application of PRMS must consider both technical and commercial factors that impact the project's feasibility, its productive life, and its related cash flows". PRMS however does however cover "unrecoverable resources" being resources that are either hopelessly inadequate for exploitation or may in part be brought into the resources/reserves category if the price of petroleum significantly increases or costs of extraction fall. Australasia's JORC is obviously seriously considering MFs social, political and environmental factors as well as the reporting the technical side of minerals exploration.

Figures 2 and 4a and b are important in the understanding of what is meant by the respective Codes and Guidelines. They are also excellent instructional tools. If there is to be welding of the two codes, then the schematics should be brought into alignment for the commonality to be fully demonstrated.

The PRMS Guidelines state, "the uncertainty in a project's recoverable quantities is reflected by the P1 (Proved), P2 (Probable) and P2 (Possible), 1C, 2C, 3C, C1, C2, and C3 - Contingent; or 1U, 2U, and 3U - Prospective resources categories. The commercial chance of success is associated with resources classes or sub-classes and not with the resources categories reflecting the range of recoverable quantities." This may be something that could be applied to JORC to facilitate bringing Inventory Mineral and Mineral Resources within JORC.

The Australian upstream petroleum industry is under scrutiny (and in some cases attack) by anti-fossil fuel campaigners, with the attacks on lease holders who wish to explore the Great Australian Bight being an example. The adoption of a Modifying Factors analyses through the exploration and early production stages could be a tool that would assist in identifying and preparing for these unfriendly actions. The adoption of MFs is recommended.

7.0 Conclusion

In using the JORC Code, the quantification and quality assessment of mineral finds is facilitated and reported in an orderly and open way. The Code, when honestly applied, is very useful in providing assurance to financiers, investors, plant suppliers, government ... , that the best possible analysis of the viability of what is being proposed is true.

Modifying Factors complement the geological assessment that is reported using JORC. MFs are important in understanding the "total viability" of a minerals/extractives project; some MFs will be more important at the inception of the project, some during production and some during the closure and some will need to be watched for the entire course of the project.

Over time some MFs will, drop in importance, become critical for success, be insurmountable and cause whole or partial project closure and/or require massaging and need the inputs of experts outside the normal fields of expertise required in the Extractive Industries. One example that is potentially pending is the reimposition of excise on diesel used in mining. Another MF is Social Licence to Operate; having SLTO is becoming increasing important for the EIs and if it is lost will be very difficult to regain. For the Australian upstream petroleum industry the PRMS system is very useful. MFs could also be used in this industry to facilitate full disclosure of Reserves and Resources to the public.

Acknowledgement

Dr Steve Mackie, Chairman of PESA, is thanked for his editing and comments for this paper. Steve "filled-in" gaps in this author's knowledge of PRMS.

Postscript, May 2020: COVID is expected to effect Australia's Extraction Industries greatly. However, the EIs have the propensity to be a major recovery factor partially since the Australian EIs will be governed by strong reporting requirements that will provide greater veracity to information flow.

Sources

Minerals Reporting

Australasian Code for Reporting of Exploration Results ... - JORC

http://www.jorc.org/docs/jorc_code2012.pdf

Coal Guidelines 2003 - JORC

http://www.jorc.org/docs/coalguidelines2003.pdf

Oil and Gas Reporting

PRMS Petroleum Resources Management System - 2018 Update

https://www.spe.org/industry/reserves.php

SPE-PRMS and Reserves Reporting in Australia, Don McMillan, Oil Gas CBM Services

http://www.oilgascbm.com.au/pdfs/reserves_in_oz.pdf

Guidelines for Application of the Petroleum Resources Management System - November 2011 - SPE-PRMS

https://www.spe.org/industry/docs/PRMS_Guidelines_Nov2011.pdf

ASX Reporting on Oil and Gas Activities

https://www.asx.com.au/documents/rules/gn32_reporting_on_oil_gas_activities.pdf

Sino Australia Oil and Gas Reference

https://www.ferrierhodgson.com/au/creditors/sino-australia-oil-and-gas-limited

Glossary of Terms

1. The largest battery in the world is claimed as being the enlarged South Australian (SA) Tesla unit; at 150MW/200MWh capacity it is not a major power source in even the South Australian grid.

2. For Grid supplementation battery storage will need to compete with pumped storage (PS); in the right circumstances PS will be reliable and cheaper than batteries.

3. Parts of Africa, S. E. Asia, the Middle East, PNG and Latin America ... have the additional SR caused by bullets and spears, criminality, riots and social collapse that cause EI project proponents reconsider their involvement, however the on-going attack by NGOs during the life-of-mine period, as is happening in Australia is a more insidious threat, with factors unknown at the time of project inception being able to destroy a technically feasible EI project at every point since inception.

4. On 24th August 2018 the NEG was removed without a replacement.

NOTE:

You are welcome to quote up to a maximum of three paragraphs from the above white paper, on condition that you include attribution to this website, as follows:

SOURCE: M.E.T.T.S. Pty. Ltd. Website http://www.metts.com.au

Share this page:

Author: Michael C Clarke

(Michael C Clarke on Google+)

M.E.T.T.S. Pty. Ltd. - Consulting Engineers PO Box 843, Helensvale QLD 4212, Australia TEL: (07) 5502 8093 • (Int'l) +61-7-5502 8093 EMAIL: metts[at]metts.com.au Copyright • Privacy • Terms of Use © 1999-2020 M.E.T.T.S. Pty. Ltd. All Rights Reserved. |

.