M.E.T.T.S. - Consulting Engineers > White Papers > Helium: will it be the next mineral to boom in Australia?

Helium: will it be the next mineral to boom

in Australia?

Dr. Michael C. Clarke, FAusIMM, METTS Pty Ltd

Consulting, Mining, Chemical and Environmental Engineer

Dr Duncan Seddon, DS & A Pty Ltd

Consulting Industrial Chemist

Greg Ambrose, Consulting Petroleum Geologist

[formerly Manager of Geology for Central Petroleum Ltd.]

Helium is a strategic industrial mineral element of which the occurrence on earth is relatively rare. It has become an increasingly important substance with the advent of super conductors (especially for MRI machines) and is needed for inert gas flooding during conductive metals welding and in the manufacture of silicon and germanium crystals and wafers. It is a mineral that has major strategic uses including rocketry, space exploration and nuclear energy development.

From the 1920s to the 1970s the United States (US) had a monopoly on helium supply, with many natural gas resources in the central US having recoverable concentrations of helium, such that the US was able to establish a helium repository in Cliffside gas field near Amarillo in Texas.

Major helium finds in a number of locations outside the US has seen helium ‘democratised’ in terms of resources, prospects and supply and since 2005 – due to the high cost of maintaining the Cliffside facility – the US has been selling off its helium reserves.

The occurrence of helium is directly related to the decay of uranium and thorium in the earth’s crust where helium atoms (_ particles) are produced. Its occurrence is further determined by the rate of production versus its rate of escape into the atmosphere and indeed loss into space. Recoverable helium occurrences require a geological trapping structure, for example salt deposits, where the helium atoms can be aggregated.

Helium exploration in Australia – geological criteria

Helium deposits are widespread in Australia with commercial production achieved from the Bayu-Undan gas stream at Conoco-Phillips liquefied nitrogen gas (LNG) plant in Darwin, where the gas comes from the offshore Bonaparte Basin. Other significant helium deposits occur onshore in the McArthur, Northern Perth and Amadeus Basins amongst other smaller deposits in the Canning and Gunnedah basins.

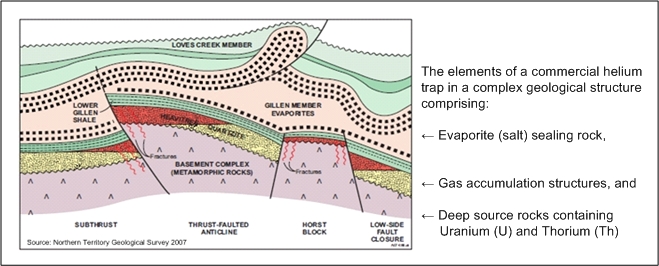

Helium is atomically small and extremely mobile thus dictating that host reservoirs are capped/sealed by relatively thick evaporite beds (usually salt) to provide the best opportunities for helium entrapment (Figure 1).

Figure 1. The Southern Amadeus helium bearing structures, evaporite sealing rock and basement source rocks.

Australian onshore/offshore basins

The Amadeus Basin

Subsalt plays in the southern Amadeus Basin are of particular interest given that two thick regional salt horizons are present across wide areas of this highly structured geological terrane. Potential reservoirs below the middle Cambrian Chandler salt have yet to test positive for helium but exploration is extremely sparse.

Conversely, of the two wells to penetrate the older Proterozoic Gillen Salt, both recovered very significant helium contents in small gas flows from reservoirs directly sub-cropping this blanket salt seal.

These occurred at Magee-1 from the Heavitree Quartzite (6.2 per cent helium was recorded from a small gas flow emanating from a significant fracture in the quartzite) and also from small gas flows from fractured granite basement in Mt Kitty-1 (up to 12 per cent helium recovered).

These are extremely high concentrations by world standards and constitute an exploration success rate of 100 per cent for pre-salt helium targets in the southern Amadeus Basin. The future for additional deposits over this very large area is thus very bright.

The Magee-1 discovery (discovered and tested in 1992 by Pacific Oil and Gas Limited)

This discovery occurred in the first well and penetrated the Gillen salt and the underlying Heavitree Quartzite in the Amadeus Basin. The well flowed 63.1 thousand standard cubic feet per day (Mcfd) on test from a large fracture in the lower part of the quartzite. The flow included nitrogen, wet gas and helium (6.2 per cent).

The Mt Kitty -1 discovery – 2014

This well was 6.3 m thick and contained 4.5 m of net sand with an average porosity of 9.0 per cent.

Careful analysis of well data – only the second well to penetrate the Gillen salt – indicates the gas flows emanated from fractured granitiod rocks of the Musgrave Province, with high helium contents derived from radiogenic basement.

Progress reports from the operator (Santos) indicate a flow test at 2144 m produced 500 Mcfd before declining to 70 Mcfd after ten minutes. A second test at 2156 m produced 530 Mcfd, decreasing to 420 Mcfd after 18 minutes.

The original primary target at Mt Kitty-1 (Palmer and Ambrose, 2012) was Heavitree Quartzite, while helium/gas charged fractured basement was a secondary target, however –as a result of pinch-out –the Heavitree Quartzite was absent. The palaeo-high appears ‘bald’ of this unit which now presents as a downdip ‘halo’ play. The exact vertical extent of mobile inert basement gases into granitoid basement remains uncertain as is the nature of fracture distribution in the structure.

In a general sense, structuring in the southern Amadeus Basin was largely manifested as thrust belts generated by major crustal shortening along the northern margin of the Musgrave Basement Block during the late Neoproterozoic. Basinward, the thrust belts are generally linear but domal structures such as Mt Kitty are also common.

Seismic coverage in this terrane is extremely sparse as is the structural definition, but a multitude of Magee/Mt Kitty ‘look alike’ structures can be expected in this vast, complex structural domain. In addition to the afore-mentioned helium deposits, there are two other instances of noteworthy levels of helium in the northern portion of the Amadeus Basin.

Ooraminna-2

In 2010 Ooraminna-2 recorded a gas flow of 150 Mscfd with a helium content of 0.22 per cent from the Neoproterozoic Pioneer Sandstone. This is a simple anticlinal trap as is the Palm Valley field 105 km to the west which produces gas with a helium content of 0.15 per cent from the Pacoota and Stairway Sandstones, both of Ordovician age.

The Gunnedah, Canning and McArthur Basins

Wilga Park and Meda

Two other natural gas accumulations, namely Wilga Park in the Gunnedah Basin and Meda in the Canning Basin, contain significant concentrations of helium in their gas (0.45 per cent and 0.5 per cent respectively (McKay, 1987).

Egilabria-2

Recent clean-up flow testing of the Egilabria-2 (Armour Energy 2013) well located in the Meso-proterozoic McArthur Basin produced high methane, helium and very low carbon dioxide content gas and seismically defined, deep shale fairways have been located in both the Lawn Creek Shale and Riversleigh Shale; exploration is ongoing.

Australian production

The development of the liquefied natural gas industry in Australia has allowed the first production of helium in the southern hemisphere.

In March 2010 BOC Limited opened a helium production facility in Darwin which produces approximately 4.25 million standard cubic metres of helium a year. This is achieved by refining a waste stream (containing up to three mole per cent helium) produced during liquefied natural gas (LNG) processing in the nearby Conoco Phillips plant. The gas stream emanates from Jurassic-Early Cretaceous rocks of the Bonaparte Basin in the Timor Sea.

Unconventional gas includes tight-gas, shale-gas and coal seam gas (CSG). All of these categories of natural gas are increasingly becoming major resources of natural gas in Australia, but it is only tight-gas plays that are likely to become helium producers.

With shale-gas and CSG, the escape of helium through the cleat/cleavage makes significant helium entrapment unlikely - Egilabria-2 may be an exception. Tight-gas structures with evaporite capping plus high concentrations of nitrogen are good candidates to be a sources of recoverable helium. Fraccing, combined with advanced drilling technology, is thus likely to be the key to many new helium developments.

Helium economics and extraction

The world has seen the passing of the US monopoly of helium during the past twenty years. Although still a major producer and although it has considerable explored reserves (and potential reserves) and a large national stockpile, the US no longer has a monopoly.

Since the mid-2000s Australia has an established helium production plant in Darwin which produces around three per cent of the world’s annual helium output, a similar quantity to what is used in Australia.

Helium, as a by-product of LNG production, has come to the fore, with Qatar and Algeria becoming major producers. Russia, Poland and potentially Indonesia also have helium resources.

Helium as a by-product of liquefied natural gas production – a primary exploration target

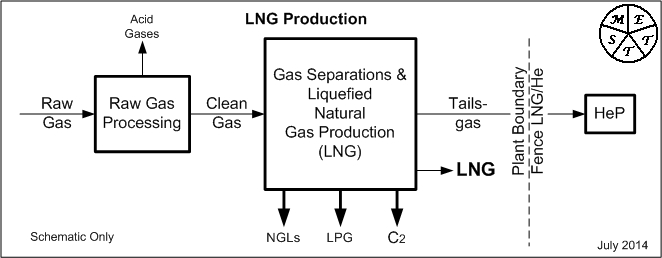

The LNG-related helium production is basically the production of a relatively concentrated helium containing tails-gas from a raw natural gas flow that contains only a small percentage of helium (Figures 2 and 3).For example, Qatar has around 0.04 per cent of helium in its raw natural gas but can still economically produce liquefied helium.

Figure 2.The production of a tails-gas stream post liquefied natural gas (LNG) production.

The split of returns from the LNG (plus C2 being ethane and ethylene, LPG and natural gas liquids (NGLs)) will depend on the raw feed gas composition and the markets for each product, while the split on helium versus hydrocarbons will be dependant of the relative compositions and the specific markets for products, especially the He.

The traditional split between a primarily hydrocarbon versus a primarily helium project has been put at three per cent helium in the raw feed gas (for US operations). Examples of splits include:

• Darwin– 0.3 per cent

• Amadeus Basin– 0.15-0.2 per cent

• Southern Amadeus Basin–nine per cent.

• Qatar – 0.04 per cent

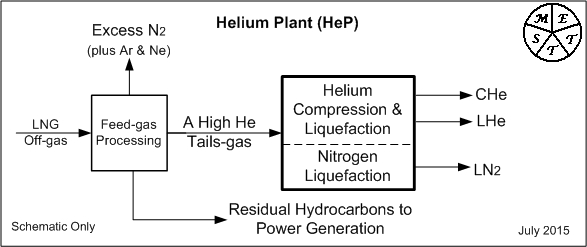

Exceedingly high splits, such as those in the Amadeus Basin require a process to handle high raw helium gas feeds (Figure 3).

Figure 3. The processing of the tails gas to produced liquid helium and compressed helium products and a liquid nitrogen co-product.

Products, co-products and by-products of helium production

The products from helium processing can include:

• industrial grade (60-80 per cent)

• A-grade helium gas (>99 per cent)

• A-grade liquefied helium (>99.995 per cent).

The present market value of liquid helium (LHe) is around $US7/scm in Asia, greater than 15 times the value of landed LNG.

Nitrogen is a useful co-product. It can be used as a non-flammable drilling gas, as an enhanced oil recovery driver, as a thermal buffer/insulator in LHe production and cartage and as a coolant in LNG and LHe production; in fact liquid nitrogen co-product is a means of distributing and marketing ‘cold’.

All helium is associated with some combustible gas (principally hydrocarbons and occasionally hydrogen) and this combustible gas is useful in generating electricity for internal plant use and for export. Excess methane could also be processed in small regional LNG works as future transport fuel.

Understanding the project dynamics of helium production

Being able to classify a helium resource as a potential helium reserve, helium and hydrocarbon reserve or a hydrocarbon reserve with a viable helium by-product is the first step in creating a helium project. Being an industrial mineral (albeit a valuable mineral) helium requires a sound logistics scenario for monetisation and where it is a minor constituent in a LNG play, the LNG play must be primarily viable to make the ‘helium fly’.

Australia has multiple helium plays that can be developed if the potential resources can be converted to reserves and the cost of production is in kilter with overseas practice.

Australia is in a good position to supply East and South Asia with helium, but there will be competitors. If Australia can develop technologies such as nuclear energy that uses helium as a working fluid and/or a super-conductor coolant, then we will have power technology plus necessary commodity packages to offer the market.

Further information is available at www.metts.com.au.

References

Palmer N and Ambrose GJ, 2012. Mt Kitty Prospect, Southern Amadeus Basin. In: Ambrose GJ and Scott J, (Editors, 2012). Proceedings of the Third Central Australian Basins Symposium, Alice Springs, 16-17 July 2012. pp 14.

Palmer N and Ambrose GJ, 2012. The Mt Kitty Prospect: Regional thrust belts in the southern Amadeus Basin host numerous wet gas and helium plays. Pesa News. pp 48-49.

McKay BA, 1987. Helium Resources and Developments in Australia. BMR Record 1987/22.

The above article was originally published in: Ausimm Bulletin, December 2014.

Share this page:

NOTE:

You are welcome to quote up to a maximum of three paragraphs from the above white paper, on condition that you include attribution to this website, as follows:

SOURCE: M.E.T.T.S. Pty. Ltd. Website http://www.metts.com.au

Share this page:

M.E.T.T.S. Pty. Ltd. - Consulting Engineers PO Box 843, Helensvale QLD 4212, Australia TEL: (07) 5502 8093 • (Int'l) +61-7-5502 8093 EMAIL: metts[at]metts.com.au Copyright • Privacy • Terms of Use © 1999-2014 M.E.T.T.S. Pty. Ltd. All Rights Reserved. |

.